Pendle Explained: A Comprehensive Guide

Understanding YT Tokens: Why They Don't Burn and How Their Value Changes

In the world of Pendle Finance, it's essential to grasp the dynamics of Yield Tokens (YT) and why they don't burn over time. Despite their consistent yields and points, the value of YT tokens fluctuates based on their remaining time to maturity.

YT Tokens: No Burning, Consistent Earnings

Unlike some tokens that burn over time, YT tokens retain their quantity throughout their lifecycle. This means that you continue to hold the same number of YT tokens from acquisition to maturity. Consequently, you consistently earn the same amounts of yields and points with them.

Steady Yield and Points: Regardless of Price

One crucial aspect of YT tokens is that each YT token earns points and yields equivalent to one underlying Locked Reward Token (LRT) until maturity, irrespective of their current market price. This ensures a stable stream of earnings for YT holders regardless of market fluctuations.

Price and Time to Maturity: The Relationship

The value of YT tokens fluctuates based on their proximity to maturity. As the maturity date approaches, YT tokens become cheaper in the market. This pricing mechanism follows a simple logic: why pay more for a token that will earn both points and yields for a shorter period?

Understanding YT Token Dynamics

In summary, YT tokens in Pendle Finance do not burn over time, providing consistent earnings for holders. However, their market value varies depending on their remaining time to maturity. As the maturity date nears, YT tokens become cheaper, reflecting the reduced duration for which they will continue to generate earnings. This understanding of YT token dynamics is crucial for investors looking to optimize their strategies within the Pendle ecosystem.

YT Tokens: A Tradable Asset with Market Determined Value

In the realm of Pendle Finance, Yield Tokens (YT) represent a tradable asset whose price is solely determined by market dynamics. Unlike deposits or collaterals, YT tokens are subject to market forces, making them a versatile tool for yield traders.

YT: Tokenized Access to Yields and Points

YT tokens offer a unique proposition: each YT token earns yields and points equivalent to one underlying yield-bearing asset, without requiring ownership of the asset itself. This abstraction allows traders to access the benefits of yield-bearing assets without the need for direct ownership.

Stable Yields, Fluctuating Value

Despite their fluctuating market value, YT tokens maintain a constant rate of earning points and yields until maturity. As the maturity date approaches, the value of YT tokens declines, reflecting the reduced duration for which they will continue to generate earnings.

Market Dynamics: Impact on YT Price

The value of YT tokens is subject to various market factors. Traders can influence YT prices through buying or selling pressure. Additionally, fluctuations in the price of underlying assets, such as ETH, can also impact YT prices, as YT tokens are traded against these assets (e.g., rsETH, eETH).

Conclusion: Understanding YT Trading Dynamics

In summary, YT tokens in Pendle Finance offer traders a flexible avenue to access yields and points without direct asset ownership. However, their market value is influenced by supply and demand dynamics, as well as fluctuations in the price of underlying assets. Understanding these trading dynamics is essential for navigating the YT market effectively within the Pendle ecosystem.

Understanding Real vs. Implied Yield on Ether.fi example

Before diving into Pendle Finance (Pendle), it's crucial to grasp the concepts of real and implied yield. Let's use eETH from EtherFi as an example:

- Real Yield: eETH offers a 3.29% APY, representing the tangible returns earned today from holding eETH.

- Implied Yield: Holding eETH also accrues EtherFi loyalty points, currently non-monetized but will have value post-campaign. Each eETH earns 10,000 EF points/day and 24 Eigenlayer points/day.

What Does Pendle Do?

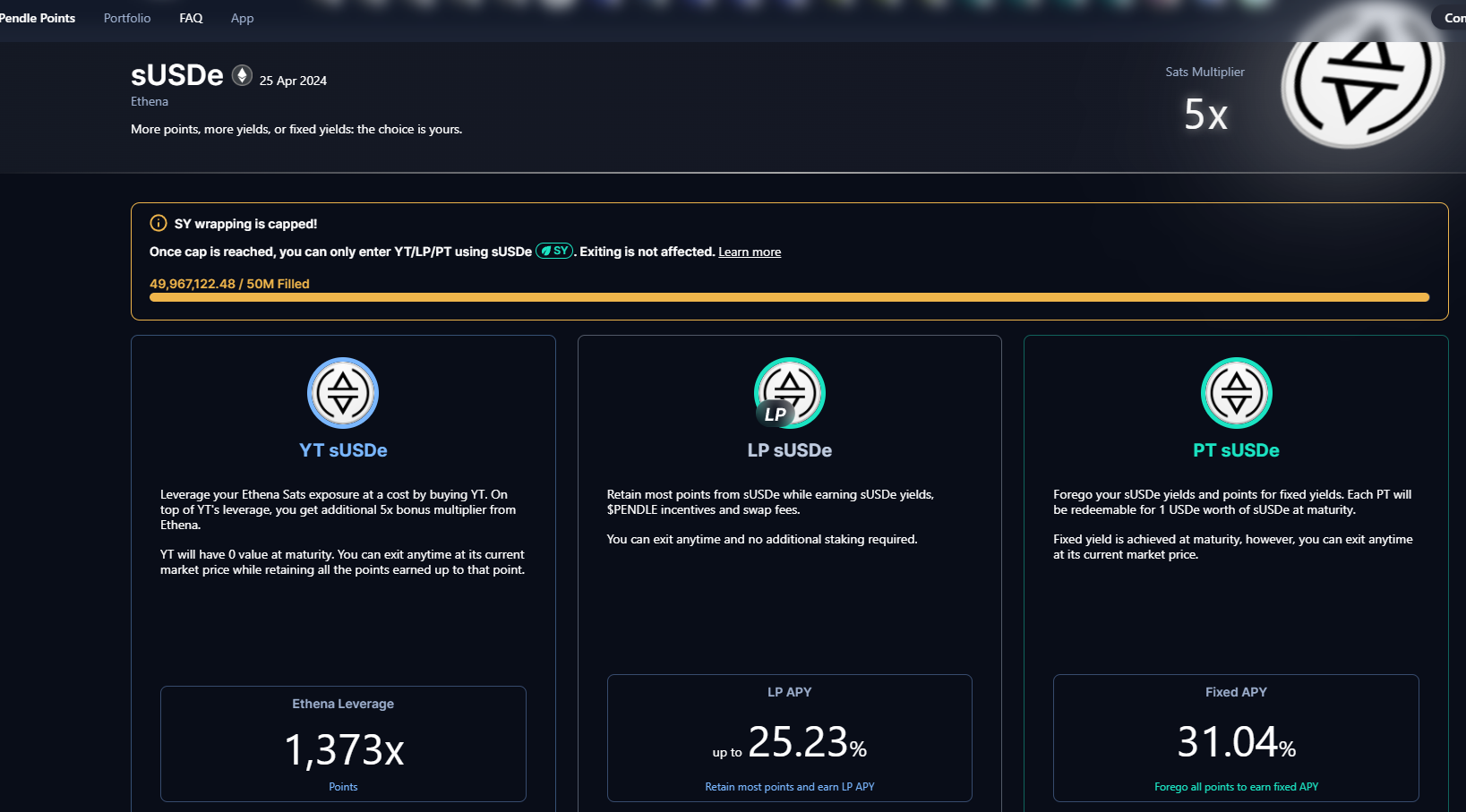

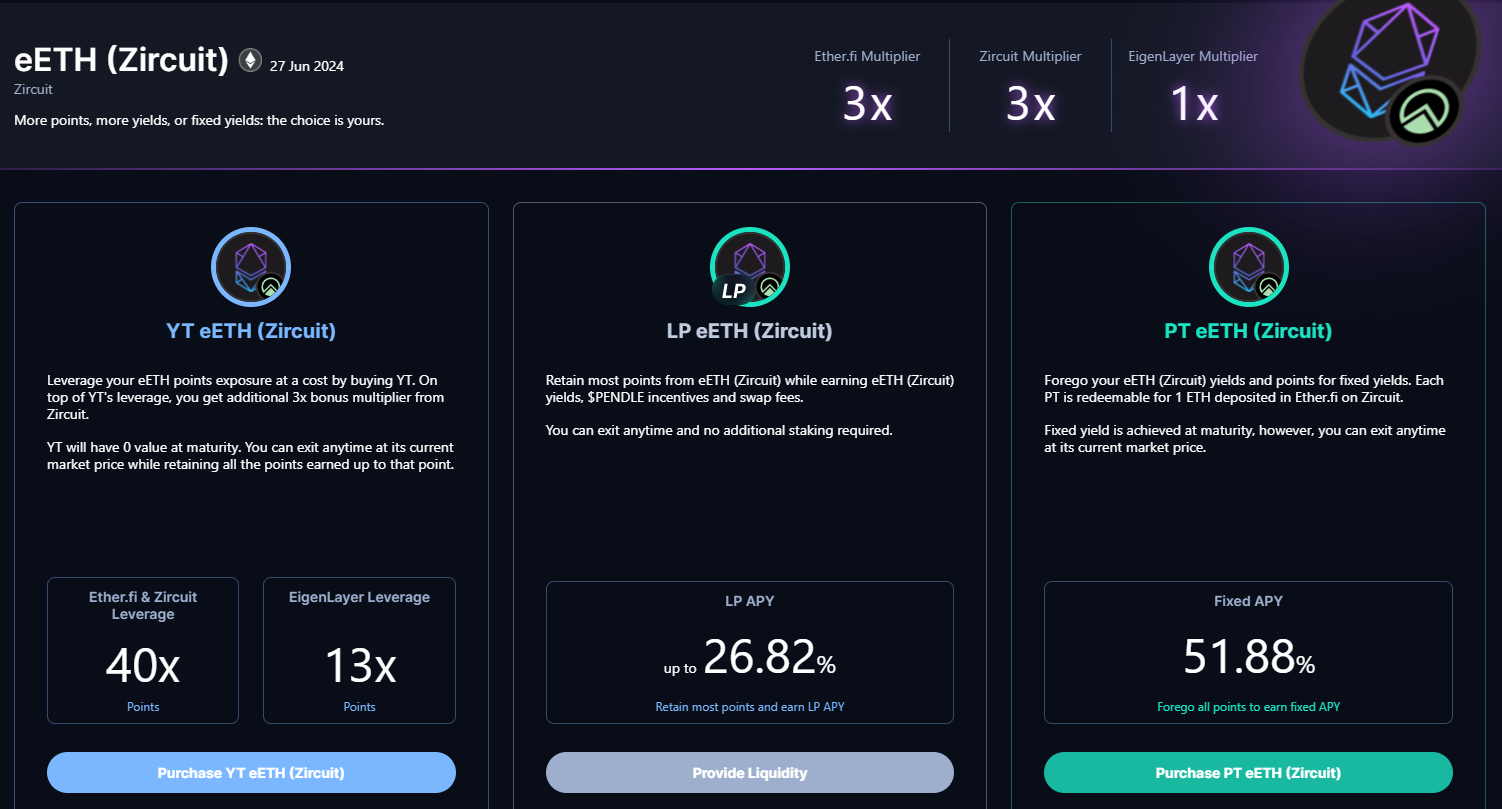

Pendle simplifies dual-yield assets like eETH by wrapping them to create a standardized yield basket. This yield is then divided into two components and tokenized into Principal Tokens (PT) and Yield Tokens (YT):

- PT (Principal Tokens): Ideal for real yield enthusiasts. Swapping eETH for PT offers a fixed APY (currently 42%) but forfeits all implied yield (EF points).

- YT (Yield Tokens): Suited for point enthusiasts. Swapping eETH for YT forfeits protocol yield but offers a multiple on implied yield. Currently, YT holders earn 24x EF points and 12x Eigen points.

How are PT and YT Priced?

The prices of PT and YT are determined by their ratio and always sum up to 1 of the underlying asset. For instance, if 9 people mint PT and 1 person mints YT, PT would cost 0.9 ETH and YT would cost 0.1 ETH.

Understanding Leverage and Yield Generation

- Leverage: YT offers high leverage due to more PT being minted. This results in an outsized implied yield, explaining the significant leverage on points.

- Yield Generation: Both PT and YT yields originate from the full basket of underlying collateral provided to Pendle. Thus, YT earns points on all eETH swapped for both PT and YT, and vice versa for PT.

Maturities and Exiting YT Position

- Maturities: PT and YT have attached maturities, guaranteeing yield until maturity. At maturity, PT is redeemable for 1 eETH, rendering YT worthless.

- Exiting YT Position: You can swap out of YT back to eETH at any time based on the current exchange rate, though gains or losses may occur. The pools remain liquid for swapping back if YT price exceeds 0.

Analyzing EtherFi YT-eETH Offering

- EtherFi's season 2 campaign is underway, with plans for a 6% supply airdrop.

- YT-eETH offers substantial point earning potential, with projections indicating significant returns over the campaign period.

- Each 1 ETH in YT purchased could earn approximately $18,979, equating to around a ~2,124% APY (do your own research as these projections may vary).

Exit Strategy

- YT decays to 0 on maturity, necessitating a plan for retaining a portion of the principal.

- Monitor YT price daily and closely and set personalized risk tolerances to manage investments effectively.

In conclusion, Pendle offers a unique avenue for maximizing yields on dual-yield assets like eETH. With a clear understanding of its mechanisms and potential returns, investors can navigate the platform effectively to optimize their investment strategies.

Ensuring Convertibility: The Integrity of PT Tokens in Pendle

In the dynamic landscape of decentralized finance (DeFi), questions often arise regarding the integrity and convertibility of tokens within various protocols. Specifically, in the case of Pendle Finance, concerns may arise about the redemption of Principal Tokens (PT) at a 1:1 ratio with the underlying asset. Here, we delve into this topic to provide clarity on the matter.

Immutable Convertibility: The Foundation of PT Tokens

One of the fundamental principles of Pendle Finance is the immutable convertibility of PT tokens. This means that regardless of market fluctuations or external factors, 1 PT token can always be redeemed for 1 unit of the underlying asset. This ironclad guarantee is enshrined in the smart contract architecture of Pendle, ensuring the integrity of the platform's tokenization process.

The Tokenization Process: SY, YT, and PT

To understand the convertibility of PT tokens, it's essential to grasp the tokenization process within Pendle. When a yield-bearing asset is deposited into Pendle, it is wrapped into a SY (Pendle's native wrapper). Subsequently, the asset is tokenized into two components: Yield Tokens (YT) and Principal Tokens (PT). While YT tokens accrue yields until maturity, PT tokens represent the principal and are redeemable for the underlying asset at maturity.

Risk Factors and External Dependencies

While Pendle's smart contracts guarantee the convertibility of PT tokens, it's crucial to acknowledge the inherent risks associated with underlying assets. Factors such as slashing events, liquidity pool drains, or defaults within lending protocols can impact the value of the underlying asset. However, these risks do not undermine the convertibility of PT tokens themselves.

Mitigating Risks and Ensuring Security

Pendle provides comprehensive documentation outlining the risks associated with various underlying yield-bearing tokens. This transparency empowers users to make informed decisions and mitigate risks effectively. Additionally, Pendle's architecture ensures that risks associated with one underlying asset do not affect other Pendle PT tokens.

Upholding Integrity in Tokenization

The convertibility of PT tokens within Pendle Finance is a cornerstone of the platform's design. Through robust smart contract mechanisms and transparent risk documentation, Pendle ensures that PT tokens can always be redeemed for the underlying asset at a 1:1 ratio. While external factors may pose risks to underlying assets, the integrity of PT token convertibility remains steadfast, safeguarding user investments within the Pendle ecosystem.

Understanding YT Leverage and Pricing Dynamics in Pendle

In the vibrant ecosystem of Pendle Finance, Yield Tokens (YT) play a crucial role in facilitating the earning of points and yields on underlying Locked Reward Tokens (LRT). However, grasping the concepts of leverage and pricing dynamics associated with YT tokens is essential for navigating the platform effectively.

Consistent Earnings Regardless of Price

One key principle to understand is that 1 YT token consistently earns points and yields equivalent to one underlying LRT until maturity, irrespective of its current market price. This means that whether you paid $1, $10, or $100 for a YT token, it will still earn the same amount of points and yields as any other YT token for that specific LRT.

Leverage as a Measure of Price

Leverage in Pendle is essentially a reflection of the current price of YT tokens. It indicates how many YT tokens one underlying token would buy, taking into account the points multipliers associated with them. In essence, leverage serves as a metric to understand the pricing of YT tokens in the market.

The Impact of Maturity on Pricing

As the maturity date approaches, the price of YT tokens tends to decrease. This decrease in price makes YT tokens more accessible to new entrants, as one unit of the underlying token can buy more YT tokens. However, it also means that these tokens will earn points and yields for a shorter duration, as the maturity date is closer.

The Irrelevance of Initial Price

In summary, the pricing dynamics of YT tokens in Pendle are influenced by factors such as leverage and maturity dates. Regardless of the price paid for a YT token, its ability to earn points and yields remains consistent until maturity. While pricing may fluctuate over time, the fundamental principle of YT tokens earning based on underlying LRT assets ensures a fair and transparent ecosystem for all participants.